To CEOs: You’ve Been Misguided by Antiquated…

May 22, 2020

Art Koch’s Profit Chain® Series

Volume 3 | Number 5 | May 2020

One important lesson that COVID-19 has taught Executive Leaders is that their assumptions are misguided when assessing the Total Cost of Ownership, TOC.

Total Cost of Ownership (TCO): TCO includes all of the direct and indirect costs associated with an asset or acquisition over the entire life cycle of the product or service. TCO includes not just the purchase price, but also the cost of transportation, handling and storage, damage and shrinkage, taxes and insurance, and redistribution costs.

Art Koch’s Profit Chain®

Total Cost of Ownership Model

In my experience over the years, I have noticed most organizations make procurement and sourcing decisions based solely on the purchase price. Leaders will talk about the total cost of ownership; few, if any, actually use a TCO calculation or model that determines an accurate TCO. When there is a model, the numbers are usually off by 25 to 40% because it underestimates the actual offshoring costs.

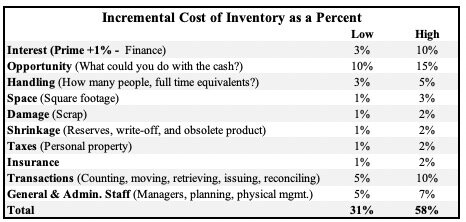

Additionally, many organizations have only used incremental inventory carrying cost of Prime +1% when making make vs. buy decisions. The actual inventory carrying cost is between 31% and 58% of COGS when all costs are considered. These numbers are the cost metrics that should be used when determining the internal rate of return – IRR, for long-term inventory carrying cost when calculating the TCO.

Breaking the Cycle

It’s time to break the cycle of being misguided by antiquated costing and incorrect performance indicators. It’s no longer a game of paying the lowest price for goods purchased from a supplier. We can no longer assume the relevance or accuracy of the costing models from the 1960s and 1970s when attempting to strategically reduce today’s TCO. And the only “levers to pull” or options for cost reduction are NOT negotiating lower prices and longer payment terms from suppliers and transportation are for larger shipments and slower modes of transportation from freight carriers.

Organizations, whether it’s executive leaders or supply chain professionals, are greatly underestimating the cost of carrying inventory, and the impact of greatly reduced lead-times;

Inventory Is Evil! ™

“Inventory delays problem resolution. Delays cost money.”

Shorter Lead-times Improves:

- Responsiveness and flexibility to customer demand and design changes.

- Rework and Scrap is reduced with higher inventory velocity.

- Obsolesce and Slow-moving inventory are reduced with higher inventory velocity. Phase-in and Phase-out of new part numbers becomes easier and makes it quicker to implement changes since there are fewer variables and inventory to consider and manage.

- Forecasting solutions become simpler, easier to maintain, and less costly.

- When Total inventory decreases, Customer Service and Profits improve.

Art Koch’s Profit Chain®

“Dramatic improvements to inventory velocity increased customer service and corporate profits.”

Building A Total Cost of Ownership Model

The above model displays the seven functions that make up the Total Cost of Ownership and the components for each of their cost elements.

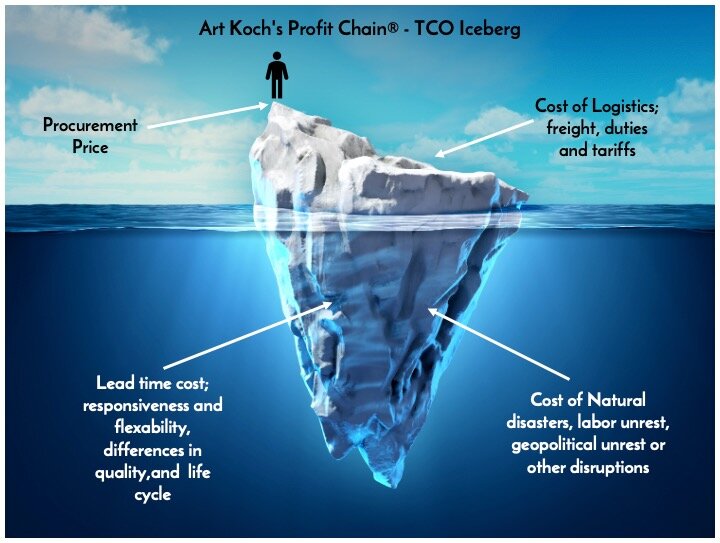

The TCO Iceberg, below, illustrates how 90% of the costs are hidden and not taken into account for outsourcing and decisions. The top 10% of the iceberg, which we can see, are the only cost used to make TCO decisions.

The Iceberg illustration highlights the fundamental differences between Professionals and Amateurs. Professionals build their models to include ALL costs.

I am never one to shy away from a good debate. However, be careful of the critics who can’t back up their biases with facts and data. Transportation are one of the common critics of reducing order size and having frequent deliveries. They argue, if we start to receive items more frequently, costs will increase. We need to reframe the argument. The amount of freight over time doesn’t change, just the frequency of deliveries. Actually, the predictability of delivery times, dates and weights greatly improves. In case you missed it; variability is the curse of cost containment. Executive Leadership needs to demand the same level of professionalism from support organizations as they do of Operational Excellence practitioners.

Be cautious of cost center accounting. To break this cycle of erroneous and antiquated costing, and to shift the paradigm, the focus must be on TCO and not just on a few localized costs.

Entropy Busters®

“Stop letting the process manage you! Become the champion of your game plan and achieve sustainable profits.”

I would like to give special thanks to Brian Keyser for recommending this newsletter. If you have any suggestions for future newsletters, please feel free to e-mail me or call me to discuss ideas.

Categorized in: Art Koch Profit Chain® Tips

Tags: , Changemanagement, supplychainmanagement, TCO